Calendar

Dividend

Dividend policy

Within the framework of the Belgian RREC legislation, the Company is required to distribute, as return on capital, an amount at least corresponding to the positive difference between the following amounts:

- 80% of an amount (‘corrected profit’) determined in the form published in Chapter III of Annex C of the Royal Decree of 13 July 2014 ;

- and the net decrease in the debt of the public RREC during the financial year.

Each year, the dividend is paid following the Annual General Meeting, which is held on the second Tuesday of May. Keep an eye on our calendar to keep up to date with all the dates related to the dividend.

2025 Dividend

For the 2025 financial year, Aedifica’s Board of Directors anticipates a gross dividend of €4.00 per share (subject to a 30% withholding tax, see below). The dividend is expected to be paid out in May 2026, following the approval of the annual accounts by the Annual General Meeting of 12 May 2026.

| Coupon | Period | Ex-coupon date | Est. payment date | Gross dividend | Net dividend |

| 36 | 01/01/2025 – 31/12/2025 | 14/05/2026 | 19/05/2026 | €4.00 | €2.8 |

2024 Dividend

For the 2024 financial year, Aedifica distributed a gross dividend of €3.90 per share (+3% compared to the 2023 dividend).

As a RREC investing more than 80% of its portfolio in residential European healthcare real estate, the withholding tax for Aedifica investors amounted to only 15%. After deduction of the 15% withholding tax, the total net dividend amounted to €3.315.

| Coupon | Period | Ex-coupon date | Payment date | Gross dividend | Net dividend |

| 35 | 01/01/2024 – 31/12/2024 | 15/05/2025 | 20/05/2025 | €3.90 | €3.315 |

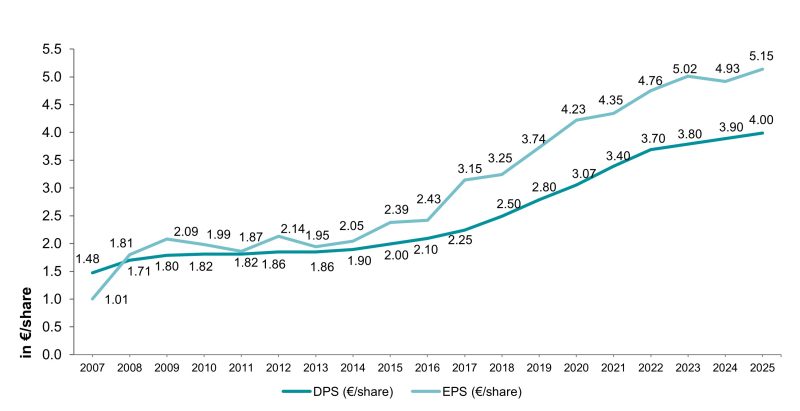

Strong dividend track record

Aedifica has achieved a strong dividend track record since its incorporation in 2005. Year after year, we have increased our dividend or at least kept it stable. Since incorporation, we have already distributed a total of €45.30 (gross) per share in dividends.

By clicking on the link below you will find an overview of all dividends paid by coupon.

Dividend history

* Prorata of the €4.60 dividend (18 months) over 12 months.

- €4.00/share total gross dividend for 2025 to be distributed in May 2026

- €45.30/share total gross dividend distributed since incorporation

Withholding tax

Since January 1, 2026, the applicable withholding tax rate on dividends distributed by Aedifica amounts to 30%.

Until 31 December 2025, Aedifica shareholders benefited from a reduced withholding tax of 15% instead of 30%, which is granted to shareholders of REITs investing more than 80% of their portfolio in residential healthcare real estate situated in a member state of the European Economic Area. Following Brexit, a transition regime was provided for UK assets acquired prior to 1 January 2021 so that they could be included in the calculation of the 80% threshold until the end of the 2025 financial year.

However, as this transition regime has now ended and – given its portfolio in the UK and a number of non-residential care properties – Aedifica no longer meets the 80% threshold, the Company no longer qualifies to benefit from the reduced withholding tax rate of 15% since 1 January 2026.

Shareholder meetings

Extraordinary General Meeting – 11 July 2025 -

Extraordinary General Meeting – 12 June 2025 -

Annual General Meeting – 13 May 2025 -

On 27 March 2025, the share capital of Aedifica is represented by 47,550,119 shares.

Each share is entitled to one vote. The Company has 8,067 own shares.

- Minutes of the AGM -

- Convocation & agenda -

- Proxy -

- 2024 Annual Report -

- Statutory financial statements (only in Dutch) -

- Auditor’s report (statutory – only in Dutch) -

- Curriculum vitae Raoul Thomassen -

- Curriculum vitae Rikke Lykke -

- Remuneration policy 2025 -

- Explanatory note on proposed changes to the remuneration policy -

Extraordinary General Meeting – 14 May 2024 -

On 4 April 2024, the share capital of Aedifica is represented by 47,550,119 shares.

Each share is entitled to one vote. The Company has 277 own shares.

Annual General Meeting – 14 May 2024 -

On 4 April 2024, the share capital of Aedifica is represented by 47,550,119 shares.

Each share is entitled to one vote. The Company has 277 own shares.

- Minutes of the AGM (in Dutch) -

- Coordinated Articles of Association (14 May 2024) -

- Convocation & agenda -

- Proxy -

- 2023 Annual Report (LD) -

- Statutory financial statements (only in Dutch) -

- Auditor’s report (statutory – only in Dutch) -

- Curriculum vitae Serge Wibaut -

- Curriculum vitae Stefaan Gielens -

- Curriculum vitae Katrien Kesteloot -

- Curriculum vitae Elisabeth May-Roberti -

- Curriculum vitae Kari Pitkin -

- JRCI NV/SA – Jaarverslag (only in Dutch) -

- JRCI NV/SA – Jaarrekening (only in Dutch) -

- JRCI NV/SA – Commissarisverslag (only in Dutch) -

- Mélot BV/SRL – Jaarverslag (only in Dutch) -

- Mélot BV/SRL – Jaarrekening (only in Dutch) -

- Mélot BV/SRL – Commissarisverslag (only in Dutch) -

Annual General Meeting – 9 May 2023 -

- Minutes of the AGM (in Dutch) -

- Agenda -

- Convocation -

- Proxy -

- Vote by correspondence -

- Curriculum vitae Sven Bogaerts -

- Curriculum vitae Ingrid Daerden -

- Curriculum Vitae Pertti Huuskonen -

- Curriculum Vitae Luc Plasman -

- Curriculum Vitae Charles-Antoine van Aelst -

- Curriculum Vitae Marleen Willekes -

- Annual report 2022 -

- Auditor’s report (statutory – only in Dutch) -

- Statutory financial statements (only in Dutch) -

Extraordinary General Meeting – 28 July 2022 -

On 28 June 2022, the share capital of Aedifica is represented by 36,382,329 shares.

Each share is entitled to one vote. The Company has no own shares.

Annual General Meeting – 10 May 2022 -

On 30 March 2022, the share capital of Aedifica is represented by 36,308,157 shares.

Each share is entitled to one vote. The Company has no own shares.- Minutes of the AGM (Dutch) -

- Convocation -

- Proxy -

- Vote by correspondence -

- Annual financial report -

- Auditor’s report (statutory – only in Dutch) -

- Curriculum vitae Henrike Waldburg -

- Familiehof NV – Jaarrekening (only in Dutch) -

- Familiehof NV – Jaarverslag (only in Dutch) -

- Familiehof NV – commissarisverslag (only in Dutch) -

- stamWall SRL – Comptes annuels (only in French) -

- stamWall SPRL – Rapport de gestion (only in French) -

- stamWall SRL – Rapport du commissaire (only in French) -

Extraordinary General Meeting – 19 April 2022 -

On 18 March 2022, the share capital of Aedifica is represented by 36,308,157 shares.

Each share is entitled to one vote. The Company has no own shares.

Extraordinary General Meeting – 30 July 2021 -

On 30 June 2021, the share capital of Aedifica is represented by 36,071,064 shares.

Each share is entitled to one vote. The Company has no own shares.

Extraordinary General Meeting – 11 May 2021 -

On 20 April 2021, the share capital of Aedifica is represented by 33,086,572 shares.

Each share is entitled to one vote. The Company has no own shares.

Annual General Meeting – 11 May 2021 -

On 2 April 2021, the share capital of Aedifica is represented by 33,086,572 shares.

Each share is entitled to one vote. The Company has no own shares.- Minutes of the AGM (Dutch) -

- Convocation -

- Proxy -

- Vote by correspondence -

- Agenda -

- Management report (consolidated) -

- Management report (statutory – only in Dutch) -

- Auditor’s report (consolidated) -

- Auditor’s report (statutory) -

- Consolidated financial statements -

- Statutory financial statements (only in Dutch) -

- Remuneration report -

- Remuneration policy -

- Curriculum vitae Serge Wibaut -

- Curriculum vitae Stefaan Gielens -

- Curriculum vitae Katrien Kesteloot -

- Curriculum vitae Elisabeth May-Roberti -

Extraordinary General Meeting – 20 April 2021 -

On 19 March 2021, the share capital of Aedifica is represented by 33,086,572 shares.

Each share is entitled to one vote. The Company has no own shares.

Extraordinary General Meeting – 8 June 2020 -

Extraordinary General Meeting – 20 May 2020 -

- Agenda -

- Buitenheide – jaarverslag (only in Dutch) -

- Résidence de la Paix – jaarverslag (only in Dutch) -

- Verlien – jaarverslag (only in Dutch) -

- Draft amendment Coordinated Articles of Association -

- Current version of the articles of association indicating the amendments -

- Buitenheide -commissarisverslag (only in Dutch) -

- Résidence de la Paix – commissarisverslag (only in Dutch) -

- Verlien – commissarisverslag (only in Dutch) -

- Convocation -

- Buitenheide – jaarrekening (only in Dutch) -

- Résidence de la Paix – jaarrekening (only in Dutch) -

- Verlien – jaarrekening (only in Dutch) -

- Information document -

- Proxy -

- Special report of the Board of Directors – art. 7:199 -

- Vote by correspondence -

Annual General Meeting – 22 October 2019 -

- Agenda -

- 2018/2019 consolidated financial statements -

- Auditor’s report (consolidated) -

- Management report (consolidated) -

- Convocation -

- Proxy -

- Minutes of the AGM (French) -

- Remuneration report -

- 2017/2018 statutory financial statements (only in Dutch) -

- Management report (statutory – only in Dutch) -

- Auditor’s report (statutory) -

- Arcadia – commissarisverslag (only in Dutch) -

- Arcadia – Jaarrekening (only in Dutch) -

- Arcadia – Jaarverslag (only in Dutch) -

- Avorum – commissarisverslag (only in Dutch) -

- Avorum – Jaarrekening (only in Dutch) -

- Avorum – Jaarverslag (only in Dutch) -

- CI Beerzelhof – commissarisverslag (only in Dutch) -

- CI Beerzelhof – Jaarrekening (only in Dutch) -

- CI Beerzelhof – Jaarverslag (only in Dutch) -

- Coham – commissarisverslag (only in Dutch) -

- Coham – Jaarrekening (only in Dutch) -

- Coham – Jaarverslag (only in Dutch) -

- Het Seniorenhof – commissarisverslag (only in Dutch) -

- Het Seniorenhof – Jaarrekening (only in Dutch) -

- Het Seniorenhof – Jaarverslag (only in Dutch) -

- Residentie Sorgvliet – commissarisverslag (only in Dutch) -

- Residentie Sorgvliet – Jaarrekening (only in Dutch) -

- Residentie Sorgvliet – Jaarverslag (only in Dutch) -

- VSP Kasterlee – commissarisverslag (only in Dutch) -

- VSP Kasterlee – Jaarrekening (only in Dutch) -

- VSP Kasterlee – Jaarverslag (only in Dutch) -

- VSP – commissarisverslag (only in Dutch) -

- VSP – Jaarrekening (only in Dutch) -

- VSP – Jaarverslag (only in Dutch) -

Extraordinary General Meeting – 22 October 2019 -

Extraordinary General Meeting – 4 October 2019 -

Annual General Meeting – 23 October 2018 -

- Auditor’s report (consolidated) -

- Auditor’s report (statutory) -

- 2017/2018 statutory financial statements (only in French) -

- Management report (consolidated) -

- Management report (statutory – only in French) -

- Remuneration report -

- Agenda -

- 2017/2018 consolidated financial statements -

- Proxy -

- Convocation -

- Minutes of the AGM (only in Dutch) -

- Coordinated Articles of Association (20 November 2018) -

- Optional dividend – press release -

- Information memorandum with respect to the 2017/2018 optional dividend -

- Special report of the Board of Directors in accordance with article 602 BCCA (in Dutch) -

- Auditor’s report in accordance with article 602 BCCA (in Dutch) -

Extraordinary General Meeting – 16 April 2018 -

Extraordinary General Meeting – 29 March 2018 -

Annual General Meeting – 27 October 2017 -

- Auditor’s report (consolidated) -

- Auditor’s report (statutory) -

- 2016/2017 statutory financial statements (only in French) -

- Management report (consolidated) -

- Management report (statutory – only in French) -

- Remuneration report -

- Agenda -

- -

- Convocation -

- 2016/2017 consolidated financial statements -

- Proxy -

- Minutes of the EGM (French) -

Extraordinary General Meeting – 28 October 2016 -

Annual General Meeting – 28 October 2016 -

- Coordinated Articles of Association (12 December 2016) -

- Results optional dividend – press release -

- Information memorandum with respect to the 2015/2016 optional dividend – addendum -

- Optional dividend: modification of terms – press release -

- Minutes of the EGM (French) -

- Presentation -

- Information memorandum with respect to the optional dividend -

- Optional dividend – press release -

Extraordinary General Meeting – 11 October 2016 -

Extraordinary General Meeting – 14 December 2015 -

Extraordinary General Meeting – 23 October 2015 -

Annual General Meeting – 23 October 2015 -

Extraordinary General Meeting – 6 October 2015 -