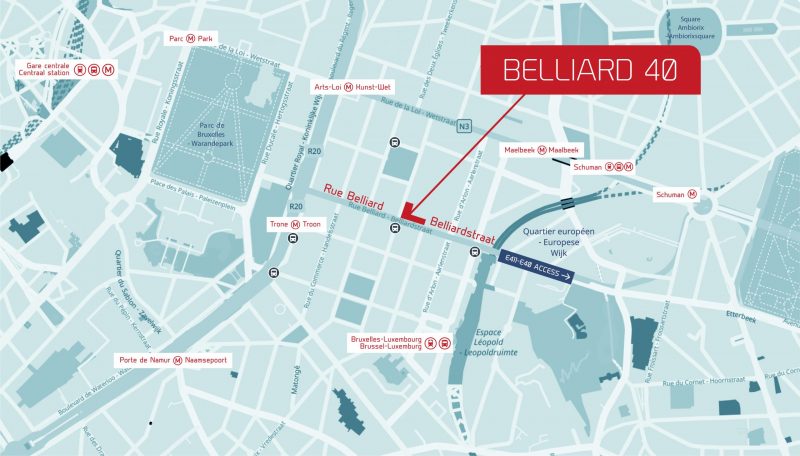

Get directions

Do you want to pay us a visit at the office? The coffee is ready, you are more than welcome.

We have made sure that you can easily get to our head office in Brussels by public transport: you can reach us by train, metro, bus and bicycle.

If you come by train, you can get off at the station of Brussels-Luxemburg or Brussels-Central. From there you can easily continue on foot to rue Belliard 40. If you come by international train, you get off at Brussels-South station and take metro line 2 or 6 to Trône/Troon or Arts-Loi/Kunst-Wet.

If you come by metro, you can take line 1 or 5 to Arts-Loi/Kunst-Wet or Maelbeek/Maalbeek, or you can take line 2 or 6 to Trône/Troon or Arts-Loi/Kunst-Wet.

If you come by bus, you can take line 21, 27 and 64 to Trêves/Trier, or line 27, 34, 38, 64, 80 and 95 to Science/Wetenschap.

If you take a villo! sharing bike, you can easily park your bike in the Charlemagne/Karel De Grote bike station right in front of our office.

Of course, you can also reach us by car, but we encourage you to consider the environment and use public transport or other eco-friendly transportation options.